Hurricane Season 2021 is almost over, but winter has its own flood risks

We’re just past the peak of the 2021 Atlantic hurricane season. However, that doesn’t mean that you should forget about flood insurance until 2022. There’s still about a month left in the typical hurricane season, and winter brings its own potential for flooding.

What months are the worst for hurricanes?

By convention, hurricane season begins on June 1, but Mother Nature can run a little early. Tropical storm Ana officially opened the 2021 season on May 22. This was the

seventh consecutive year that started the Atlantic hurricane season early.

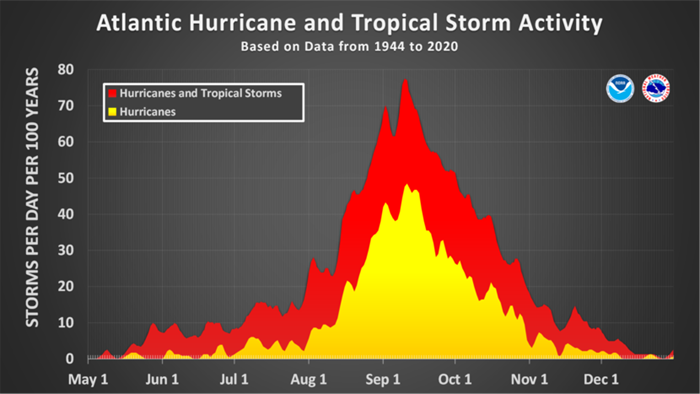

The prime time for Atlantic tropical storms runs from mid-August to mid-October. This year,

14 of the 20 named storms (so far) occurred during this time. According to an October 5 article in the Orlando Sentinel:

“While not surpassing the record years of 2005 and 2020, the 2021 season has already generated 20 named storms, and could very well generate more before the Nov. 30 end of the season. The average year observed between 1991 and 2020 is 10.9 named storms, according to CSU measurements.”

Image Source: National Hurricane Center

Image Source: National Hurricane Center

It has been another rough season, certainly, but now we’re past the peak with cooling ocean waters dampening tropical storm activity. The official end to the season is November 30, and we have our fingers-crossed that we don’t need to flip over to the supplemental list of storm names before Thanksgiving.

Download and share with your clients: Seasonal Flood Risks

November Hurricanes Can Still Impact the US

Even with the threat of hurricanes waning as we move toward the end of the calendar year, your clients may continue to be at risk. November hurricanes rarely make landfall in the US, but their impact can still be felt.

Tropical Storm Eta, which peaked as a Category 4 hurricane that wreaked havoc on Nicargagua in November 2020, brought 15-20 inches of rain to some parts of Florida, leaving behind an estimated $1.5B in damages. The storm then moved into North Carolina, dropping almost 10 inches of rain in 48 hours on Raleigh and

swelling the nearby South Yadkin River from 3.5 feet to 24.5 feet.

Winter Flood Risks

As you know, water in the ground freezes and thaws more slowly than water on the surface. We may get excited for a stretch of warm weather in February, but if the ground is still frozen when all of the snow on top of melts, your clients’ homes may be in trouble. With nowhere to drain through the soil, that snowmelt can find its way into basements.

Another winter flood risk, ice jams occur when the surface of a frozen river breaks up and starts moving downstream. The ice can collect and bottleneck the river’s flow, raising the water level and causing damage to nearby homes. Or, water can build up behind the ice jam and, once the jam breaks, the water releases and rushes downstream to cause flash flooding to homes near the river bank.

Rapid snowmelt and ice jams both contributed to the

Missouri River flood of 2019, which caused over $1B in destruction to residents throughout Missouri, Nebraska, South Dakota, Iowa and Kansas. But you don’t have to

reside along the banks of a major river to be at risk for winter flooding. Last Christmas, residents of central New York and northeast Pennsylvania were checking their stockings and basements

as local river levels rose. Heavy snows followed by a shock of unseasonably warm weather caused flooding throughout the area.

What about flood insurance?

Although we’d like to breath a sigh of relief with the peak of hurricane season behind us, the potential still exists – even in winter – for your clients to suffer a loss due to flooding. When talking to your clients about flood risk, be sure to review whether their coverage is adequate. NFIP policies max out at $250,000 for building coverage and $100,000 for personal property. EZ Flood provides comprehensive, customizable coverage, so you can offer your clients up to $1.25M in property and $875,000 for personal property. That’s a significant difference in protection that your clients may want to consider.

This article is provided for general informational purposes only and is not intended to provide individualized advice. All descriptions, summaries or highlights of coverage are for general informational purposes only and do not amend, alter or modify the actual terms or conditions of any insurance policy. Coverage is governed only by the terms and conditions of the relevant policy.