5 Questions to Help Clients Choose Between the NFIP or Private Flood Insurance

The National Flood Insurance Program (NFIP) has been the main flood insurance provider in the United States since its inception in 1968. But is it the best option for your clients?

Private flood insurance provides clients with options to supplement or replace NFIP coverage. Here are five key questions to help prompt conversations with your clients and determine what kind of policy could be the best fit.

1 - Is your client’s home replacement value greater than $250,000?

If the answer is yes, then it could be a good idea to discuss flood insurance coverage limits with them. The NFIP’s maximum limit for non-condominium residential buildings is $250,000. The limit of $250,000 has become an issue for many Americans, as home values have skyrocketed in recent years.

It’s likely that many of your clients have homes valued above the NFIP limit. The U.S. Census Bureau recently reported that 79% of newly constructed homes were sold in 2020 for more than $250,000. The National Association of Realtors reported that in October of 2021 72% of sales on existing homes were also greater than $250,000.

Luckily there are two solutions you can offer to these clients: private flood insurance with higher limits than the NFIP, or private excess flood insurance in combination with the NFIP.

Private flood insurance policies, like EZ Flood, offer a maximum residential building limit of up to $1,250,000 and can be a great alternative to the NFIP. Or, clients can choose to add an excess flood policy, like Aon Edge Excess Flood which offers up to a $5,000,000 limit, in addition to their NFIP coverage.

2 - Does your client want flood coverage fast?

If your client wants to arrange flood insurance quickly, then they may want to consider private flood insurance. That’s because the Federal Emergency Management Agency, which administers the NFIP, cautions new customers to “[p]lan ahead as there is typically a 30-day waiting period for an NFIP policy to go into effect . . .” Luckily, private flood insurance policies offer another option.

EZ Flood, for example, only has a 15-day waiting period or, if used to satisfy a loan closing, has no waiting period. EZ Flood’s simplified application process, which only contains 12 underwriting questions, will save you time as well.

3 - Does your client know the value of their personal property?

Accessing your client’s personal property value can be incredibly helpful in determining the best flood policy for them. But do your clients know what their personal property is worth? If they aren’t sure, they can create a personal inventory. As they take stock of their belongings, they can add descriptions or pictures of items and serial numbers or other identifiers. Some key items to include:

Once their final tally is complete they can take note of the total personal property value. The

NFIP only covers personal belongings up to $100,000, so if your client’s property is worth more, they may want to consider private flood insurance options.

EZ Flood is one such option, which has a personal property limit of up to $875,000, or your client could consider an NFIP policy combined with

Aon Edge Excess Flood for a combined building and contents limit of up to $5,000,000.

4 - Does your client have a pool?

If your client has a swimming pool, it’s understandable that they would want coverage for post-flooding cleanup. Homeowners may assume that the NFIP covers swimming pool cleanup, but this is

not the case.

The NFIP

does not provide coverage for swimming pools.

NFIP policyholders with flood damaged pools can be left having to fend for themselves. And repairing or cleaning up a damaged pool is no easy feat. Cleaning up a swimming pool is at best tiring and tedious if the homeowner does the cleanup, and at worst, expensive, if they hire an outside company to do it for them.

Some of the steps

involved in the process include:

- Repairing or replacing flooded electrical equipment

- Addressing possible chemical and biological contamination from flood waters

So, how can your clients help protect themselves? One option is to choose private flood insurance. EZ Flood, for example, is a great choice as it provides policyholders the option for coverage that includes up to $1,000 for swimming pool clean-up.

Private flood insurance policies like this can save policyholders the potential hassle and expense of dealing with a flood-damaged pool.

5 – Does your client want to compare options apples-to-apples?

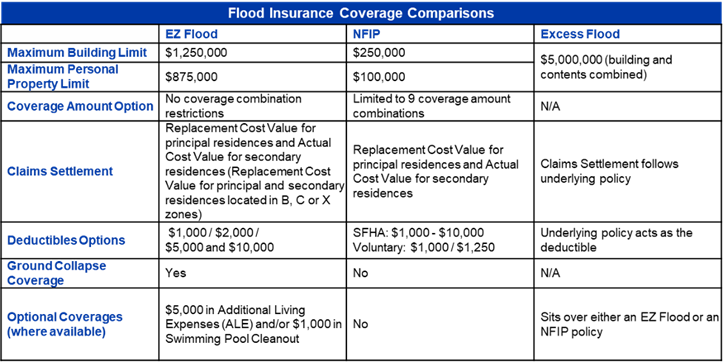

Discussing flood insurance options with clients, especially first-time homebuyers, can be a challenge. You’re likely introducing them to policies they haven’t heard of before and sometimes it helps to share a visual with them, like the below chart that summarizes the features of these different options.

As we have illustrated, private flood insurance can be a valuable tool in your arsenal of policy options. We hope the information presented above helps you discuss flood insurance coverage options with your clients..

This article is provided for general informational purposes only and is not intended to provide individualized advice. The article is not a replacement for any NFIP publications. All descriptions, summaries or highlights of coverage are for general informational purposes only and do not amend, alter or modify the actual terms or conditions of any insurance policy. Coverage is governed only by the terms and conditions of the relevant policy.